Some Of Transaction Advisory Services

The Ultimate Guide To Transaction Advisory Services

Table of ContentsThe Single Strategy To Use For Transaction Advisory ServicesTransaction Advisory Services Can Be Fun For EveryoneAbout Transaction Advisory ServicesSome Ideas on Transaction Advisory Services You Should KnowEverything about Transaction Advisory Services

This step makes sure the service looks its ideal to possible purchasers. Getting the organization's worth right is vital for a successful sale.Transaction experts action in to help by obtaining all the required info arranged, responding to concerns from buyers, and arranging brows through to business's location. This builds trust fund with customers and keeps the sale moving along. Obtaining the finest terms is key. Purchase experts use their know-how to assist company owner take care of hard settlements, meet buyer assumptions, and framework offers that match the owner's goals.

Satisfying lawful regulations is essential in any type of organization sale. They assist company owners in intending for their following steps, whether it's retired life, beginning a brand-new venture, or managing their newfound wealth.

Purchase experts bring a wealth of experience and knowledge, making sure that every element of the sale is managed properly. Via critical prep work, assessment, and settlement, TAS helps company owner attain the greatest feasible list price. By guaranteeing legal and regulatory compliance and handling due diligence alongside various other offer team participants, transaction experts reduce possible risks and responsibilities.

The Only Guide to Transaction Advisory Services

By contrast, Huge 4 TS teams: Job on (e.g., when a potential customer is performing due diligence, or when a bargain is closing and the customer needs to incorporate the business and re-value the vendor's Annual report). Are with charges that are not linked to the offer shutting effectively. Earn charges per engagement somewhere in the, which is much less than what investment financial institutions make also on "small offers" (but the collection likelihood is also a lot greater).

, but they'll concentrate a lot more on audit and valuation and much less on subjects like LBO modeling., and "accountant only" topics like test equilibriums and how to walk via occasions using debits and debts rather than financial statement modifications.

Transaction Advisory Services Things To Know Before You Get This

that show just how both metrics have actually changed based on products, networks, and clients. to evaluate the precision of management's past forecasts., including aging, inventory by product, average degrees, and stipulations. to determine whether they're completely fictional or rather credible. Specialists in the TS/ FDD groups might likewise speak with administration regarding whatever over, and they'll compose a comprehensive report with their searchings for at the end of the process.

The power structure in Deal Services varies a bit from the ones in financial investment financial and personal equity careers, and the basic shape resembles this: The entry-level function, where you do a great deal of information and financial evaluation (2 years for a promotion from right here). The next level up; comparable work, yet you get the even more interesting little bits (3 years for a promotion).

In specific, it's hard to get advertised beyond the Manager degree because few individuals leave the job at that stage, and you require to begin showing proof of your capacity to generate profits to development. Allow's start with the hours and way of life since those are simpler to define:. There are occasional late evenings and weekend work, yet nothing like the read the full info here frenzied nature of financial investment banking.

There are cost-of-living changes, so anticipate reduced settlement if you're in a less costly area outside significant economic (Transaction Advisory Services). For all placements other than Companion, the base pay makes up the bulk of the total compensation; the year-end benefit may be a max of 30% of your base wage. Usually, the very best means to raise your incomes is to change to a different firm and work out for a higher income and bonus offer

The Facts About Transaction Advisory Services Revealed

You could obtain into company advancement, but financial investment banking gets harder at this phase since you'll be over-qualified for Analyst duties. Business finance is still an alternative. At this stage, you should simply remain and make a run for a Partner-level function. If you want to leave, perhaps transfer to a customer and do their appraisals and due persistance in-house.

The major problem is that since: You generally need to join another Large 4 group, such as audit, and work there for a couple of years and afterwards move right into TS, work there for a couple of years and after that relocate into IB. And there's still no assurance of winning this IB duty because it depends upon your area, customers, and the hiring market at the time.

Longer-term, there is likewise some threat of and due to the fact that examining a firm's historical economic information is not precisely brain surgery. Yes, humans will certainly constantly require to be entailed, but with more innovative modern technology, lower headcounts could potentially support customer involvements. That said, the Transaction Services group beats audit in regards to pay, job, and departure possibilities.

If you liked this write-up, you may be thinking about reading.

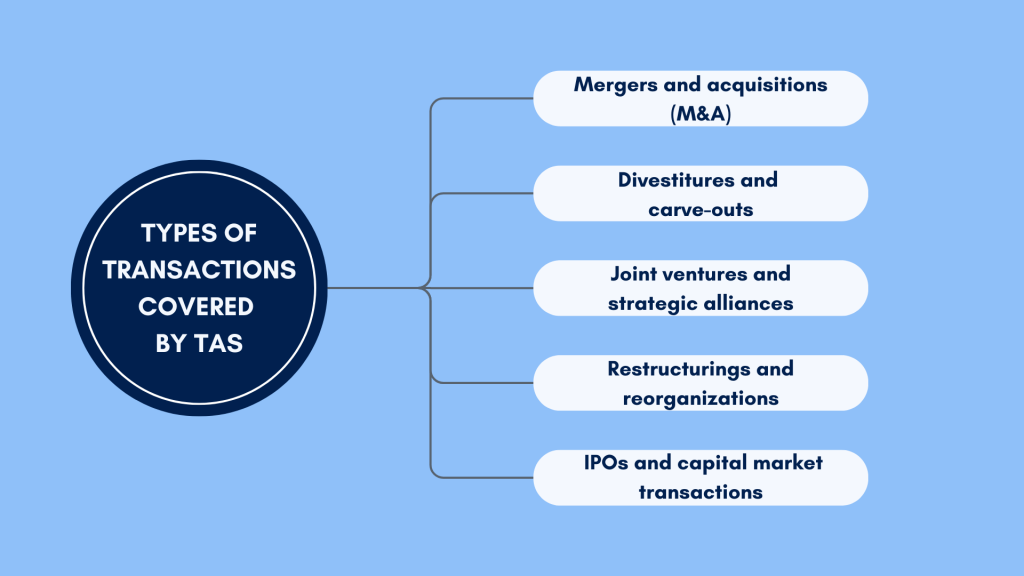

The 8-Minute Rule for Transaction Advisory Services

Establish advanced financial frameworks that help in identifying the actual market worth of a firm. Give consultatory work in connection to company appraisal to help in additional info negotiating and pricing frameworks. Describe the most suitable kind of the bargain and the kind of factor to consider to employ (money, supply, earn out, and others).

Create activity plans for threat and exposure that have been recognized. Perform combination preparation to identify the procedure, system, and business changes that may be called for after the bargain. Make numerical quotes of assimilation costs and advantages to examine the financial reasoning of integration. Set standards for incorporating divisions, technologies, and service procedures.

Recognize possible decreases by lowering DPO, DIO, and DSO. Analyze the potential consumer base, sector verticals, and sales cycle. Take into consideration the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due persistance supplies vital insights into the performance of the company to be gotten concerning danger evaluation and value creation. Identify temporary alterations to funds, financial institutions, and systems.